This update uses ocean container shipping data and intelligence from Xeneta and eeSea.

Insight from Peter Sand, Xeneta Chief Analyst:

Far East to US

"The backdrop is still one of oversupply compared to demand and that is seen clearly in the fact rates are still not back to where they were a month ago despite a fairly chunky increase in the past week.

"Shippers should reflect on this weaker market the next time a carrier asks for a general rate increase (GRI), because it would not appear to be justified against the level of demand versus capacity."

Far East to Europe

"Far East to North Europe currently shows both demand and supply strength - carriers are adding capacity and rates are still edging up rather than softening.

"Spot rate increases are even stronger from Far East to Mediterranean, with sustained double-digit growth over the past month, but this is fueled by reducing capacity on this trade.

"While the data suggests a stronger market from Far East to Europe, you cannot ignore developments in the Red Sea, particularly the recent announcements of some ships transiting the Suez Canal again. This shows carriers are warming up for a return to the region, but there are a number of steps to go through before this happens at a largescale and transits remain at low numbers compared to before the Red Sea crisis escalated."

Data highlights

Market average spot rates – 4 December 2025:

- Far East to US West Coast: USD 2051 per FEU (40ft container)

- Far East to US East Coast: USD 2843 per FEU

- Far East to North Europe: USD 2418 per FEU

- Far East to Mediterranean: USD 3314 per FEU

- North Europe to US East Coast: USD 1585 per FEU

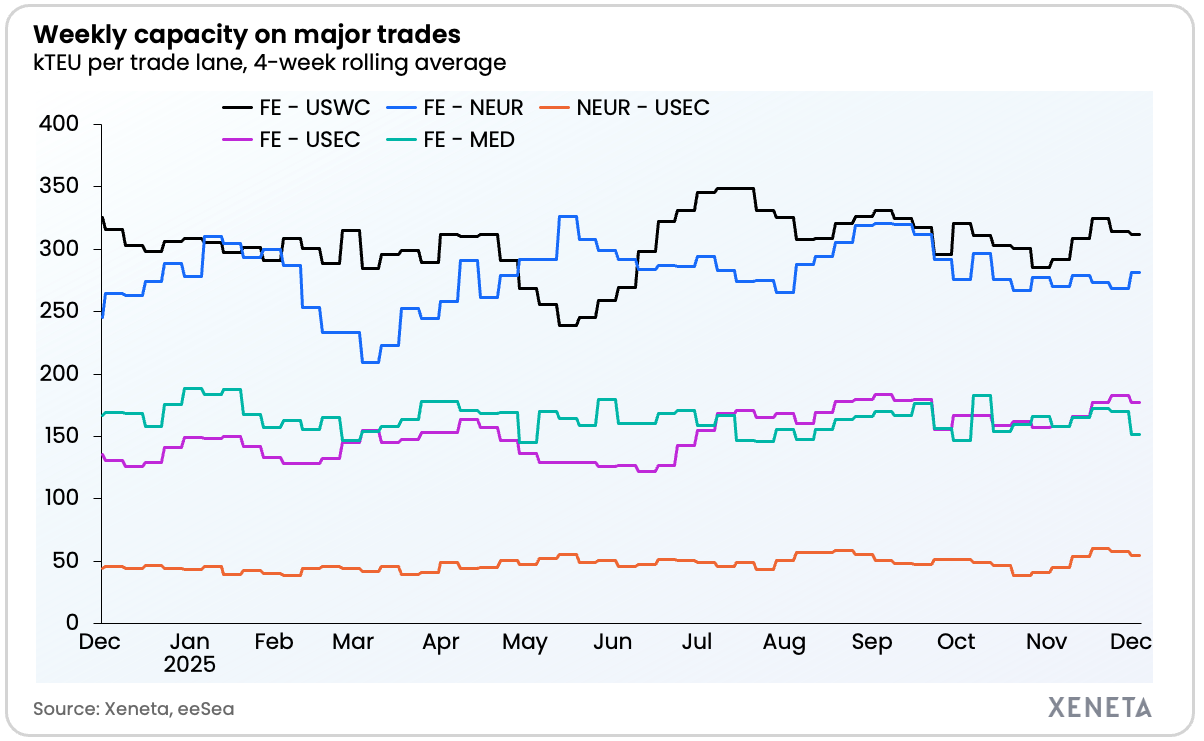

Offered capacity (4 week rolling average) – w/c 1 December 2025:

- Far East to US West Coast: -0.7% from a week ago

- Far East to US East Coast: -2.8% from a week ago

- Far East to North Europe: +4.9% from a week ago

- Far East to Mediterranean: -10.7% from a week ago

- North Europe to US East Coast: -6.4% from a week ago

Trade view: Far East to US West Coast

Rates

- Week-on-week: Spot rates ticked up ~7% (≈ +USD 140/FEU). This suggests a short-term rebound in pricing after the late-November trough.

- Month-on-month: Despite the weekly uptick, rates are still down ~32% (≈ –USD 950/FEU). The lane remains significantly cheaper than early November, indicating that the market is still digesting earlier capacity and demand shifts.

Capacity

- Week-on-week: Offered capacity is essentially flat to slightly down (~1%), pointing to no material supply expansion in the most recent week.

- Month-on-month: Versus early November, capacity is up ~7% (≈ +20k TEU), so the month-long picture is one of higher supply and sharply lower pricing, even if the very latest week shows a modest rate recovery.

Trade view: Far East to US East Coast

Rates

- Week-on-week: Spot rates rose about 8% (≈ +USD 220/FEU), another sign of short-term firming on the Transpacific trade lane from the Far East into the US East Coast.

- Month-on-month: Rates are still ~21% lower than a month ago (≈ –USD 750/FEU). Like the US West Coast, this trade shows a significant month-on-month correction, with only a partial recovery in the latest week.

Capacity

- Week-on-week: Offered capacity eased ~3%, indicating some trimming of supply in the most recent week, which likely helped support the rate uptick.

- Month-on-month: Compared to early November, capacity is up ~12% (almost +20k TEU). The broader monthly story is more ships, lower rates, with the last week showing a tentative stabilization.

Trade view: Far East to North Europe

Rates

- Week-on-week: Spot rates increased ~4% (≈ +USD 100/FEU), extending an upward trend.

- Month-on-month: Rates are also ~4–5% higher than a month ago (≈ +USD 100/FEU). This trade lane stands out as one of three where month-on-month pricing is higher, not lower.

Capacity

- Week-on-week: Offered capacity jumped roughly 5% (≈ +13k TEU).

- Month-on-month: Capacity is up ~4% versus early November (≈ +11–12k TEU).

Trade view: Far East to Mediterranean

Rates

- Week-on-week: This is the strongest weekly mover: rates surged about 13% (≈ +USD 380/FEU).

- Month-on-month: Versus early November, rates are up ~15% (≈ +USD 420/FEU). This marks the lane as a clear outperformer with sustained upward pressure on spot levels.

Capacity

- Week-on-week: Offered capacity fell sharply, ~11% (≈ –18k TEU).

- Month-on-month: Capacity is down ~4% (≈ –6k TEU).

Trade view: North Europe to US East Coast

Rates

- Week-on-week: Rates are flat, showing no meaningful change over the past seven days.

- Month-on-month: Compared with early November, rates are up a modest ~2–3% (≈ +USD 35/FEU). The lane looks relatively stable, with only mild upward drift over the month.

Capacity

- Week-on-week: Offered capacity declined by ~6% (≈ –3.7k TEU), hinting at some short-term supply discipline.

- Month-on-month: Yet versus early November, capacity is up a substantial ~22% (≈ +9.8k TEU). The broader monthly trend is significant capacity growth, even though the latest week shows a small correction.

Trade view: North Europe → US East Coast:

- Pricing is stable to slightly firmer month-on-month, with capacity significantly higher than a month ago but trimmed back in the latest week.

- Overall, this lane looks balanced, with no dramatic moves compared to the sharper swings seen from the Far East.

Source: Xeneta